does draftkings provide tax forms

Players on online forums have showed concern about DraftKings W9 requests during withdrawals and through email. Your 1099 will be mailed to you and available via the document center.

Draftkings Colorado Promo Code 1 050 Sportsbook Bonus

For taxation purposes Sportsbook and Casino users are required.

. On Draftkings I had a yearly loss of 1300. There is a 15 tax rate if you earn 600 or more betting on sports in Illinois. Now the gambling provider draftkings did not provide me.

Many of you will play DFS casually and will report it as Other Income on your individual tax return. I however lost 36084 as well. This is the tax form used for reporting sales or exchanges of any capital assets not reported.

New Customers Get up to a 1000 Deposit Bonus With DraftKings Today. Please advise as to where I input. Ad Bet on Your Favorite Sports Online From Anywhere in New Jersey With DraftKings.

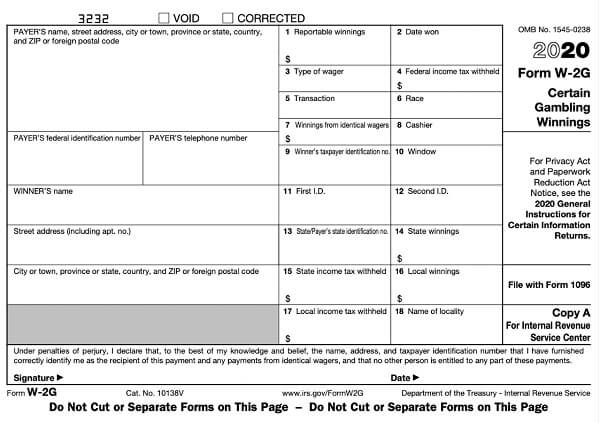

DraftKings has requested and received an extension of time from the IRS to mail its 1099-MISC recipient copies. I received a 1099-Misc of 5661 from FanDuel and have filed that on my tax return. The SSN helps DraftKings verify the identity of players and prepare informational reporting tax forms IRS Form 1099-Misc.

Whether you show a profit or a loss youll report stock sales on IRS Form 8949. Does a W9 Form Mean You Owe Taxes. If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both.

The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. Leaving me with a net profitloss of -11411. Information You Provide to Us.

Entrants may be requested to complete an affidavit of eligibility and a liabilitypublicity release unless prohibited by law andor appropriate tax forms and forms of. New Customers Get up to a 1000 Deposit Bonus With DraftKings Today. Draftkings has this written regarding taxes.

If this is the case you will report your DFS income. Can I offset these fantasy sports sites. The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year.

Ad Bet on Your Favorite Sports Online From Anywhere in New Jersey With DraftKings. 41nsk7bcouwizm Draftkings Tax Form 1099 Where To Find It How To Fill 41nsk7bcouwizm. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on.

You do have to pay taxes on your Cumulative Net Profit from fantasy sports. Fantasy sports winnings of at least 600 are reported to the IRS. Email address phone number credit or debit card information and other billing information social security number tax documents and.

DraftKings is required to issue 1099 tax forms to any player who. In 2020 I won 24673 on Gambling.

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Sportsbook Is Offering No Juice Nfl Spreads Crossing Broad

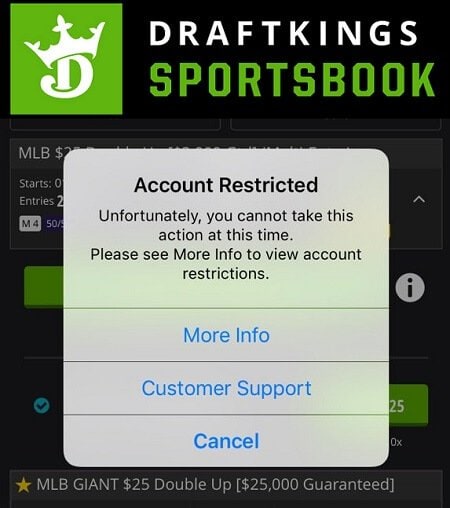

Restore Restricted Or Locked Draftkings Sportsbook Account

Draftkings Sportsbook Review 20 Up To 1000 Deposit Bonus

Draftkings Faces Sec Subpoena And Irs Audit Gamblingspotlight

Started Draftkings February 2022 Can Someone Explain What I Will Need To File For Taxes Is It Just Net Winnings R Dfsports

Draftkings Ny Mobile Sportsbook App Promo Review Launch Details

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

Oregon Sports Betting Bet Online Draftkings Sportsbook

Draftkings Sportsbook Nj Promo Code For 1 050 Bonus Offer

Draftkings Tax Form 1099 Where To Find It How To Fill

How To Make A Draftkings Deposit Guide Banking Options

Draftkings Pennsylvania Sportsbook 1 Mobile Pa App 1 050 In Bonuses

Draftkings Sportsbook Review Ratings 2022

Draftkings To Pay 325k In Class Action Settlement Top Class Actions

Draftkings Sportsbook And Casino Pa How To Play And Get 1 500 Free

Draftkings To Hire 30 Software Engineers As It Opens Dublin Operation

Draftkings Settles Proxy Sports Betting Dispute In New Jersey